Credit Cards — Explained

Apr 07, 2025

How to Use Them Without Getting Burned

🖥️ Reading time: 4 minutes

Most people treat credit cards like free money. Swipe now, cry later. But if you understand how they work—and actually use them right—they can be a powerful tool to build credit, earn cash back, and give you fraud protection you won’t get with cash or debit.

Let’s break down what credit cards really are, how they work, and how to use them to your advantage—without falling into the debt trap most folks never escape from. But, if you want to fast-forward to the end, you can check out my favorite credit cards HERE.

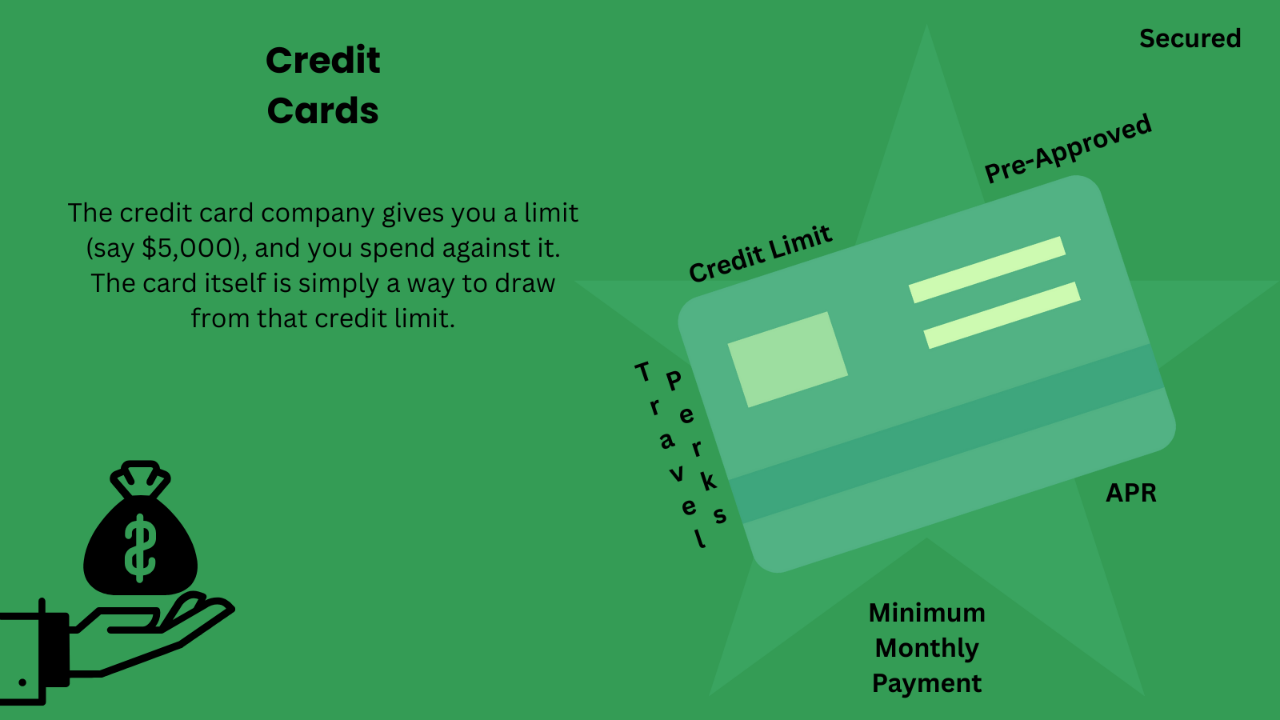

⚙️ What Is a Credit Card (Really)?

A credit card is not magic—it’s just a tool. The credit card company gives you a limit (say $5,000). You spend against that, and at the end of the month, you either:

- Pay it off in full (zero interest—this is ideal), or

- Carry a balance and get slapped with interest charges (usually 20%+ APR—yikes)

There are two types of credit cards:

- Unsecured cards – no deposit required. These are what most people use.

- Secured cards – require a cash deposit as collateral. Great if you're just starting out or rebuilding credit.

At the end of the billing cycle, you get a statement showing: What you spent, what you owe, your due date, and your minimum payment.

If you pay it all off by the due date, no interest. If you carry a balance, you’ll get hit with interest based on your APR (annual percentage rate).

⚠️ If you’re 60+ days late, your rate can jump to a penalty APR—often over 29%.

🎯 Types of Credit Cards

Credit cards come in all flavors:

- Rewards cards – Earn points, miles, or cash back on your spending.

- Cash-back cards – Straight cash for using the card (e.g., 2% back on groceries).

- Secured cards – Ideal for people with no credit or bad credit.

- Student cards – Starter cards for college students, low limits, few perks.

Pro tip: Don’t chase shiny perks if you’re carrying debt. Rewards mean nothing if you’re paying 24% interest.

💸 Hidden Credit Card Fees

Beyond interest, you’ve got to watch for:

- Balance transfer fees – Usually 2–5% when moving debt to another card.

- Late fees – If you miss a payment.

- Over-limit fees – If you go over your credit limit.

- Annual fees – Some cards charge for the “privilege” of using them. Here are my favorite no annual fee cards.

Pro tip: Read the fine print. And then read it again.

💳 Credit Cards vs. Debit Cards

Here’s the real difference:

- Debit cards pull money straight from your bank account.

- Credit cards borrow money from the issuer, which you repay later.

Debit = no debt, no impact on your credit score.

Credit = builds your credit history—if used wisely.

Another big difference? Fraud protection.

- Credit cards: You’re rarely liable for unauthorized charges.

- Debit cards: You could be out hundreds if you report fraud too late.

✅ Pros vs. Cons of Credit Cards

✅ Pros: |

⚠️ Cons: |

|

Build credit history |

High interest if you carry a balance |

|

Safer than carrying cash |

Easy to overspend |

|

Cash back and rewards |

Late fees and penalty rates |

|

Better fraud protection |

Can wreck your credit if misused |

|

0% APR intro offers (great for large purchases if paid off on time) |

⛔ Bottom line: The tool isn’t the problem—your habits are.

🔍 How to Compare Credit Cards Like a Pro

Before you sign up, compare:

|

Regular APR |

Rewards structure |

|

Balance transfer APR |

Annual fee |

|

Cash advance fees |

Signup bonus |

|

Perks (travel insurance, lounge access, no foreign fees etc.) |

➡️ Only get a card if you know how it fits into your strategy. Here is a handy comparison tool to help you find the right fit!

🧠 Why Use a Credit Card?

Used responsibly, credit cards can:

- Help you build a high credit score (which gets you better loan rates)

- Track your spending easily

- Earn cash back or points on everyday expenses

- Protect you from fraud

But, if you’re carrying a balance month to month. You’re feeding the banks.

Pro Tip: The golden rule: Only use 10% of your credit limit and pay your balance in full.

💥 Final Take: Use It, Don’t Abuse It

Credit cards are powerful. But so is a chainsaw. Use it wrong, and you’ll lose a limb.

Here’s the plan:

- Use a card with rewards that match your lifestyle.

- Pay it off in full every month (auto-pay is your best friend).

- Never spend what you can’t already afford.

- Don’t open 5 cards just to chase sign-up bonuses. Be intentional.

You’re not “winning” if you get 2% cash back while paying 24% in interest.

✅ Check out my favorite Credit Cards

✅ Take advantage of my FREE Financial Freedom Faster eBook

A credit card is a tool. If you have a balance, the tool isn’t the problem—your habits are.

- Steve

Disclaimer:

The following article is strictly the opinion of the author and is not to be considered financial/investment advice. CTL Community LLC and the author of this article do not claim to be a registered financial advisor (RIA) or financial advisor. Please visit our terms of service and privacy policy before reading this article. "Call to Leap may earn affiliate commissions from the links mentioned. Call to Leap is part of an affiliate network and receives compensation for sending traffic to partner sites such as ImpactRadius, CardRatings, MyBankTracker, and more."

Read more Curated Articles